Showing posts with label market Wisdom. Show all posts

Showing posts with label market Wisdom. Show all posts

Saturday, December 10, 2016

Saturday, November 26, 2016

Saturday, November 19, 2016

Saturday, November 12, 2016

Monday, November 7, 2016

US - S&P 500 - Triple Screen 'Technical Analysis' - Bull Support - Week 2 of November 2016.

Learning from last Week: (click here for the previous post)

Patterns:

Bears close the index below 2116 last week, Previous week's Engulfing turns into a 'Three Outside down' #Weekchart1.

Support & Resistance:

Support was at the daily 200MA #DayChart1. Resistance near the daily 5 EMA #Daychart1.

Moving Averages:

The critical EMA 5, is bullishly above the MA13, only on the Month Chart #Monthchart1.

Indicators:

The RSI in the over sold #WeekChart2.

Wrap:Bears turn the weekly Engulfing pattern into a 'Three Outside Down' #WeekChart1.

Bulls defend the 200 MA #DayChart1.

Looking forward into this Week:

Patterns:

'Evening Star' Pattern (Study Links here, here or elsewhere) is active on the Long term charts #MonthChart1.

'Three Outside down' is active on the Weekly Charts (Study Links here, here or elsewhere).

Support & Resistance:

2166 is the resistance that Bears would want to stay below. Daily 200MA is support for Bulls #DayChart1.

Moving Averages:

5 EMA on the Week chart i,e, 2122, is the mark, that the Bulls want to stay above, this week #WeekChart1.

Indicators:

TSI takes support at the 62% Fibonacci mark #MonthChart2.

Wrap:

Bulls after defending the 200 MA, look to stem the flow of red candles #DayChart1.

Bears need to stay below 2166 and prevent a Higher High #DayChart1.

SGX Nifty - Ichimoku Weekly Study - Support - Week 2 of November 2016.

View above chart at.. (Click)

Introduction / Primer to Ichimoku can be read at this link (click).

Learning from the Earlier Study:

Resisted by the Tenkan Sen (Weekly resistance) for 5 weeks, Index moves down, towards support at the Kijun Sen (Weekly Support).

Tenkan Sen provides exact resistance last week.

Chikou Span aims for what could be support, at the Senoku Span B.

Wrap:

Index resisted by the Tenkan Sen (Weekly resistance) falls to the Kijun Sen (Weekly Support).

Looking Forward into this Week:

Bears want to keep the index below the Tenkan Sen - Weekly resistance - and aim for the Kumo.

Kijun Sen - Weekly Support - important for desperate Bulls.

Chikou Span almost at the Kumo - Bearish Cross or Bullish Deflection next.

Wrap:

Bears look to continue this fall to the Kumo (Cloud).

Bulls look for green at the Kijun Sen - Weekly Support - and a Chikou Span Deflection.

Saturday, November 5, 2016

Tuesday, November 1, 2016

India - CNX Nifty 50 - Triple Screen 'Technical Analysis' - Stand Off - Week 1 of November 2016.

Learning from last Week: (click here for the previous post)

Patterns:

Index ranges between the neckline of a 'Head and Shoulder' Pattern and the daily 50MA #DaiyChart1 (Chart)

Support & Resistance:

Day Fork's middle Tyne and 50MA were resistances #DayChart1

Index gets support near the H&S neckline and Day Fork's bottom Tyne #DayChart1.

Moving Averages:

The critical EMA 5, is bullishly above the MA 13 only on the Month screen #MonthChart1.

Indicators:

The STC stays, well above the 76% Fibonacci retrace #MonthChart2.

Wrap:

Bears again defend the Daily 50MA, Bulls keep above the neckline of the H&S pattern #DayChart1.

Looking forward into this Week:

Patterns:

Head & Shoulder pattern is active on the Day chart (Study links here, here or elsewhere)

Resolution of range between the Day Fork and above the 50MA #DayChart1 determines success of above.

Support & Resistance:

Middle Tyne of the Fork on the Day chart is the first resistance #DayChart1. Neckline of the Head & Shoulder Pattern or Day Fork's Bottom Tyne are the first Supports (Link).

Moving Averages:

The 50 & 200 MA, are a in a 'Golden Cross' on the Day Screen #DayChart1.

Indicators:

The MACD and its MA are below zero #DayChart2.

Wrap:

Bears look to break below the H&S neckline, while keeping below the Daily 50MA #DayChart1.

Bulls want to break the current down trend, by closing above 8808 after breaking above the 50MA #DayChart1.

Monday, October 31, 2016

US - S&P 500 - Triple Screen 'Technical Analysis' - Bulls Survive - Week 1 of November 2016.

Learning from last Week: (click here for the previous post)

Patterns:

Bears close the index below the Day fork, Bulls manage to close above 2116 #Daychart1, Last week however engulfs the previous week #Weekchart1.

Support & Resistance:

Resistance was at the daily 50MA #DayChart1. Support near the our mark 2116 #Daychart1.

Moving Averages:

The critical EMA 5, is bullishly above the MA13, only on the Month Chart #Monthchart1.

Indicators:

The RSI heads towards the over sold #WeekChart2.

Wrap:

Bears hold the Index below the bottom Tyne of the Day Fork #DayChart1 and make a weekly Engulfing pattern #WeekChart1.

Looking forward into this Week:

Patterns:

'Evening Star' Pattern (Study Links here, here or elsewhere) is active on the Long term charts #MonthChart1.

'Engulfing Pattern' is active on the Weekly Charts (Study Links here, here or elsewhere).

Support & Resistance:

2116 is the support that Bears would want to close the week below. Daily 50MA is resistance #DayChart1.

Moving Averages:

5 EMA on the Week chart i,e, 2140, is the mark, that the Bulls want to stay above, this week #WeekChart1.

Indicators:

TSI returns from resistance at the 74% Fibonacci mark #MonthChart2.

Wrap:

Bulls after defending 2116, look to close above 2140.

Bears need to close well below 2116 and make a lower low #DayChart1.

Monday, October 24, 2016

US - S&P 500 - Triple Screen 'Technical Analysis' - Bulls Fight - Week 4 of October 2016.

Learning from last Week: (click here for the previous post)

Patterns:

Index manages to get back into the Day Fork after falling off #Daychart1, making an inside week in the process #Weekchart1, and closing above our mark 2141.

Support & Resistance:

Resistance was again at the daily 13MA #DayChart1. Support near the bottom Tyne of the Day Fork #Daychart1.

Moving Averages:

The critical EMA 5, is bullishly above the MA 13, only on the Month Chart (landing 1909 for Oct'16) #Monthchart1.

Indicators:

The RSI is near the center of the range #WeekChart2.

Wrap:

Bulls hold the Action above the bottom Tyne of the Day Fork #DayChart and make a green week.

Looking forward into this Week:

Patterns:

'Evening Star' Pattern (Study Links here, here or elsewhere) is active on the Long term charts #MonthChart1.

Support & Resistance:

Bottom Tyne of the Day Fork is support #DayChart1. Middle Tyne of the Fork on the Week chart is resistance #WeekChart1.

Moving Averages:

5 EMA on the Month chart i,e, 2141, is the mark, that the Bulls want to stay above, this month #MonthChart1.

Indicators:

TSI returns from resistance at the 74% Fibonacci mark #MonthChart2.

Wrap:

Bulls after allowing an Evening Star #MonthChart1, get a save, closing above 2141.

Bears want to keep below the middle Tyne of the Week Fork, and aim for life below 2116.

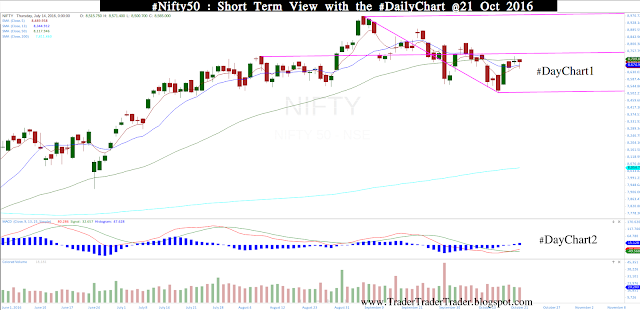

India - CNX Nifty 50 - Triple Screen 'Technical Analysis' - Neckline Hold - Week 4 of October 2016.

Learning from last Week: (click here for the previous post)

Patterns:

Index closes the week above the neckline of a 'Head and Shoulder' Pattern #DaiyChart1 Link (Click)

Support & Resistance:

New Day Fork's middle Tyne and 50MA were resistances #DayChart1

Index gets support at the H&S neckline and Day Fork's bottom Tyne #DayChart1.

Moving Averages:

The critical EMA 5, is bearishly below the MA 13 only on the weekly screen #WeekChart1.

Indicators:

The STC stays, well above the 76% Fibonacci retrace #MonthChart2.

Wrap:

Bears defend the Daily 50MA, Bulls keep above the neckline of the H&S pattern #DayChart1.

Looking forward into this Week:

Patterns:

Head & Shoulder pattern is active on the Day chart (Study links here, here or elsewhere) Bears pray the Index crashes below the Day Fork #DayChart1.

Support & Resistance:

Middle Tyne of the Fork on the Day chart is the first resistance #DayChart1. Neckline of the Head & Shoulder Pattern or Day Fork's Bottom Tyne are the first Supports (Link).

Moving Averages:

The 50 & 200 MA, are a in a 'Golden Cross' on the Day Screen #DayChart1.

Indicators:

The MACD is above its MA and its histogram is above zero #DayChart2.

Wrap:

Bears look to break below the H&S neckline, while keeping below the Daily 50MA #DayChart1.

Bulls want to break the current down trend, by closing above 8808 #DayChart1.

Monday, October 17, 2016

US - S&P 500 - Triple Screen 'Technical Analysis' - Down Fork - Week 3 of October 2016.

Learning from last Week: (click here for the previous post)

Patterns:

After the 'Evening Star' pattern triggers on the long term screen #MonthChart1, Index continues to face resistances at the middle Tyne of the Week and Day forks.#WeekChart1, #Daychart1.

Support & Resistance:

Resistance was again at the middle Tyne of the Week Fork #WeekChart1. Support near the bottom Tyne of the Day Fork #Daychart1.

Moving Averages:

The critical EMA 5, is bullishly above the MA 13, only on the Month Chart (landing 1909) #Monthchart1.

Indicators:

The RSI is near the center of the range #WeekChart2.

Wrap:

Bulls hold the Action above the bottom Tyne of the Day Fork #DayChart. Bears move index down and get another red weekly candle #WeekChart1.

Looking forward into this Week:

Patterns:

'Evening Star' Pattern (Study Links here, here or elsewhere) is active on the Long term charts #MonthChart1.

Support & Resistance:

34 MVWAP on the Week chart is support. Middle Tyne of the Fork on the Week chart is resistance #WeekChart1.

Moving Averages:

5 EMA on the Month chart i,e, 2141, is the resistance, that the Bulls want to be above, this month #MonthChart1.

Indicators:

TSI returns from resistance at the 74% Fibonacci mark #MonthChart2.

Wrap:

Bulls after allowing an Evening Star #MonthChart1, need a save, getting above 2141.

Bears want to keep below the middle Tyne of the Week Fork and aim for life below the MVWAP 34 #WeekChart1.

India - CNX Nifty 50 - Triple Screen 'Technical Analysis' - H&S Neckline - Week 3 of October 2016.

Learning from last Week: (click here for the previous post)

Patterns:

Index closes the week on the neckline of a 'Head and Shoulder' Pattern #DaiyChart1 Link(Click)

Support & Resistance:

Day Fork's middle Tyne and 13MA were resistances #DayChart1

Index closes below the 50 MA and Day Fork's bottom Tyne #DayChart1.

Moving Averages:

The critical EMA 5, bearishly below the MA 13 on all except month screen #MonthChart1.

Indicators:

The STC stays, well above the 76% Fibonacci retrace #MonthChart2.

Wrap:

Bears close below the Day Fork, Bulls close above the neckline of the H&S pattern #DayChart1.

Looking forward into this Week:

Patterns:

Head & Shoulder pattern is active on the Day chart (Study links here, here or elsewhere) Bears need the Index crashing below the neckline #DayChart1.

Support & Resistance:

Bottom Tyne of the Fork on the Day chart is the first resistance #DayChart1. Neckline of the Head & Shoulder Pattern is the first Support (Link).

Moving Averages:

The 50 & 200 MA, are a in a 'Golden Cross' on the Day Screen #DayChart1.

Indicators:

The MACD and its histogram, are below zero #DayChart2.

Wrap:

Bears look to break the H&S neckline and get below last week's low 8541 #DayChart1.

Bulls want to break the current down trend, by getting above 8808 #DayChart1.

Subscribe to:

Posts (Atom)